The Financial ‘boom and bust’ period is a fiat phenomenon that seems to happen every 8-12 years or so. Unfortunately, most of the time, it is caused by greed and stupidity and each time it happens, it hurts people like you and me rather than the people who cause it. So why will cryptocurrency succeed where fiat currency has failed?

Bitcoin (the first blockchain based financial currency technology) is a currency that was developed in 2008 to combat fiat boom and bust. It was developed by a person (or persons) called Satoshi Nakamoto (his/her/their actual identity isn’t known) and following its initial introduction onto the internet in the form of a whitepaper outlining the concept, an expanding group of enthusiasts, programmers and data scientists continued its development.

| This is the second section of the Cryptocurrency and Blockchain awareness programme, How to Crypto. |

Soon after, on Jannuary 3rd 2009, Satoshi Nakamoto created the genesis block (the first block of the bitcoin blockchain). This was during the height of the last recession and I guess Satoshi couldn’t help but included a headline of the day from the Times Newspaper, “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” Nobody knows precisely why Nakamoto included that headline but many have interpreted it as a reference to why he/they developed Bitcoin: “to cut out the banks and middlemen that he saw as corrupt and unreliable, electing to create a more people-driven currency” (quote from Investopedia article).

In those days of course, bitcoin was worth hundredths or even thousandths of a cent but as people began to understand how it worked, they gradually began to appreciate its functionality, security and the freedom to spend it without manipulation from a third party – people gradually felt that cryptocurrency would succeed where fiat could not. Bitcoin’s very existence is controversial because of this. If you own Bitcoin, you are most likely the custodian of your own coins. i.e. you didn’t deposit them in a bank and therefore you choose who they are lent to and where they are stored!

Since 2009, the cryptocurrency community has built a three trillion-dollar financial network! They’ve done this whilst quietly navigating obstacles placed in front of them from government decrees, the press and traditional financial institutions.

Banks are especially threatened by cryptocurrency. At the moment most provide a measly 0.025% return on your deposits while, at the same time, they make money legally by running trades and investments with your savings. On the other hand, cryptocurrency services usually have a return of at least 5% and in some cases up to 15% or more.

Additionally, Big Tech corporations are reported as stealing, censoring and/or monopolising our personal data, intellectual property and knowledge! As we learn how these organisations capture our personal information, we are becoming increasingly concerned about how this data is used.

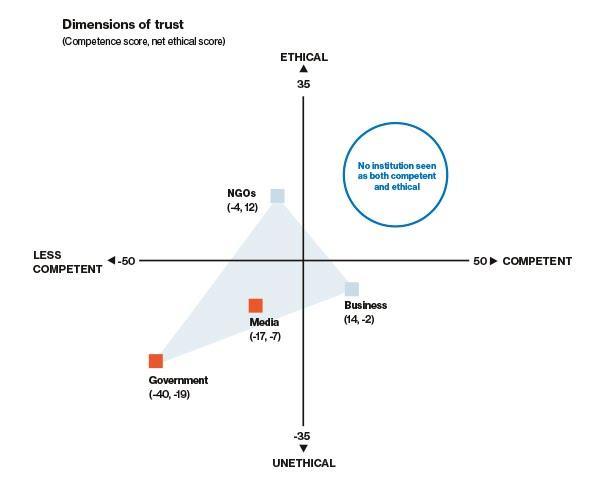

Figure: Edelman Trust Barometer,

This diagram shows that most people don’t believe any organisation to be competent and ethical. Our politicians are regularly held up to be incompetent and unfit to rule (in the UK some of them even look stupid!).

The simple reason why cryptocurrency will succeed where Fiat wont is that crypto is not influenced by institutions and governments. Bitcoin is a scarce asset that cannot be increased on demand, it cannot be changed and governed and minted by ‘quantitative easing’ at the whim of a government.

Currently we are suffering high inflation, poor trust in financial and government institutions and we worry that important, emerging technologies won’t be used to our benefit. Bitcoin was developed to save people like us from people like them! Cryptocurrency will succeed because it allows us to become the custodians of our own fortune.

Alas, it’s not all bright and cheery. As we will see later, some of the biggest frauds in the world have been conducted by blockchain projects and not all cryptocurrencies are as freedom-loving as bitcoin.

In the third section of this cryptocurrency and blockchain awareness course, we will determine the relationship between Cryptocurrency and Web3 and how this will affect adoption based on how the internet has grown.

This article is copyright 2022 by Tony Fawl, CryptoNET.

This page is part of the How to Crypto Web Series, an awareness course for beginners interested in blockchain projects and cryptocurrency investment. Please checkout the Bibliography and Glossary of Terms pages for other useful resources and links. To find out what we do, checkout the About Us page.

Disclaimer: CryptoNET.org.uk is not a registered investment, legal or tax advisor or a broker or dealer. All investment/financial opinions expressed by CryptoNET.org.uk are from the personal experiences of the owner of the website and are intended as educational and entertainment material. Best efforts are made to ensure that all information is accurate and up to date but we would still recommend that you do your own research before making investment decisions.

If you have found this page useful, please consider a small donation to help fund the site:

[crypto-donation-box]

Thank you.

Comments are closed.