Buying cryptocurrency as an investment is quite convoluted. At the moment, we can’t just go into a shop and buy crypto in the same way we can go to the bank and buy holiday currency. There are steps that need to be followed and although it sounds complicated, it isn’t difficult. It is however, important to do it correctly for security and regulatory reasons.

| This is the thirteenth section of the Cryptocurrency and Blockchain awareness programme, How to Crypto. |

Crypto is usually purchased on-line from a CEX (Centralised EXchange), a Broker or a DEX (Decentralised EXchange) using your fiat currency. You can also sell your crypto back to that exchange or broker for Fiat currency of choice. This is sometimes known as on and off ramping.

Banks simply don’t like cryptocurrency and they regularly resist allowing you to move money to and from your account for cryptocurrency trades. Your exchange too, may have a restriction of some sort in allowing you to place your money on their exchange (e.g. an amount limit or verification delay). Worse still, your bank may refuse transfers to and from a specific exchange (e.g. Binance as is currently the case with many European banks at the moment).

A bank may refuse to accept your currency once it has been converted back to fiat currency because they think you may be money laundering! Again, this happens regularly so you need to ensure you can easily move money between your cryptocurrency exchange or broker and bank. Try with small amounts first.

Choosing a Broker or Crypto Exchange

Consider your priorities. When buying cryptocurrency, do you want to leave your crypto on a secure website or hold it in your own wallet? Would you pay a small premium to buy from a marketplace without the possible interference from banking institutions and government agencies (i.e. safer but more expensive). All these things need to be considered carefully and not rushed. Lets look at three different methods of acquiring Cryptocurrency.

Buying Cryptocurrency from Brokers![]()

The easiest way to buy crypto is by using a Broker. There are quite a few and they are generally well regulated and secure. They work by charging you fees to help you purchase crypto with your fiat currency from their on-line service. This can be at a much higher rate than crypto exchanges. Some brokers claim to be free and make their money by providing your trade information to other brokerages or by selling at suboptimal prices.

The easiest way to buy crypto is by using a Broker. There are quite a few and they are generally well regulated and secure. They work by charging you fees to help you purchase crypto with your fiat currency from their on-line service. This can be at a much higher rate than crypto exchanges. Some brokers claim to be free and make their money by providing your trade information to other brokerages or by selling at suboptimal prices.

You should also note that some brokers have restrictions on the ability to move crypto on and off their system. They may say that this is a security benefit for you but it is nevertheless restrictive. The most popular brokers are Robinhood and SoFi and, at the time of writing, they do not allow you to transfer your crypto purchases off their site. This could be a problem if you want the ability to secure your own cryptocurrency!

You should also note that some brokers have restrictions on the ability to move crypto on and off their system. They may say that this is a security benefit for you but it is nevertheless restrictive. The most popular brokers are Robinhood and SoFi and, at the time of writing, they do not allow you to transfer your crypto purchases off their site. This could be a problem if you want the ability to secure your own cryptocurrency!

For these reasons, I believe that although brokerages are easy to use, they are one of the most expensive ways to buy crypto and the least flexible when it comes to personal financial security.

Central Cryptocurrency Exchanges (CEX)

These are centralised cryptocurrency exchanges owned and operated by organisations/companies from central locations. They are platforms where buyers and sellers meet to trade crypto. A CEX will usually have low fees and more complex interfaces with multiple types of trades and services including performance charts which are updated in real time. All very exciting and very intimidating if you are new:

When buying cryptocurrencies, you would first convert your fiat money into a stablecoin (lets say USDT), and use that to buy, in the above case, Bitcoin. This simple trade is known as a ‘Spot’ trade. The exchange lets you see the current price, the price trend, market volume indicators and high and low price differences. When I first saw this screen it looked very intimidating. There are however lots of videos available to teach you how to trade crypto on a wide range of exchanges. The graphic above is a screenshot of one of my favourite exchanges, Binance.

The chart in the middle is called a candle chart and it lets you see at a glance how well (or badly) the currency is doing. You can change the timescales from minutes or seconds to days, weeks and even months. Lets say that each candle in the chart represents an hour of trading. Each candlestick shows the open, high, low, and close price for each hour. The green or red colour indicates if the price closed lower (red) or higher (green). The thin lines represent the candle ‘wick’ which shows the highest and lowest prices for that time period.

A candle chart is very useful for determining the current trend for the cryptocurrency you are about to purchase. If you can see that it is on a downward trend, you may want to hold off a little until the price gets lower before you buy. It’s very difficult to guess where the lowest price will be before you purchase and can be quite frustrating while trying.

A key Central Exchange (CEX) service is the opportunity to undertake leveraged trading. If you are new to trading then the simple advice about leveraged trades is DON’T DO IT! – Seriously, 95% of the leveraged trades you make (no matter how good you think you are) will likely be very destructive to your bank balance there are very sad stories of people losing all their possessions because of leveraged trades that went wrong!

The leveraged trading definition from Wikipedia should discourage you sufficiently: “…. is the collateral that a holder of a financial instrument has to deposit with a counterparty to cover some or all of the credit risk the holder poses for the counterparty.” Basically it refers to the buying of securities (crypto) with cash borrowed from a broker (the exchange), using the bought securities as collateral. It enables you to magnify the effect of any profit or loss made on the securities. The securities serve as collateral for the loan. The element that most people fail to realise however is that the leverage is inversely proportional to the investment. If you short-sell leverage trade an investment for 1000 dollars by 10x. and the price goes up by 10%, your trade will be ‘recked‘! and your 1000 dollars will be taken by the exchange. Central Exchanges make a lot of money from people who think they can trade the crypto market and they have many financial incentives for you to give it a try!

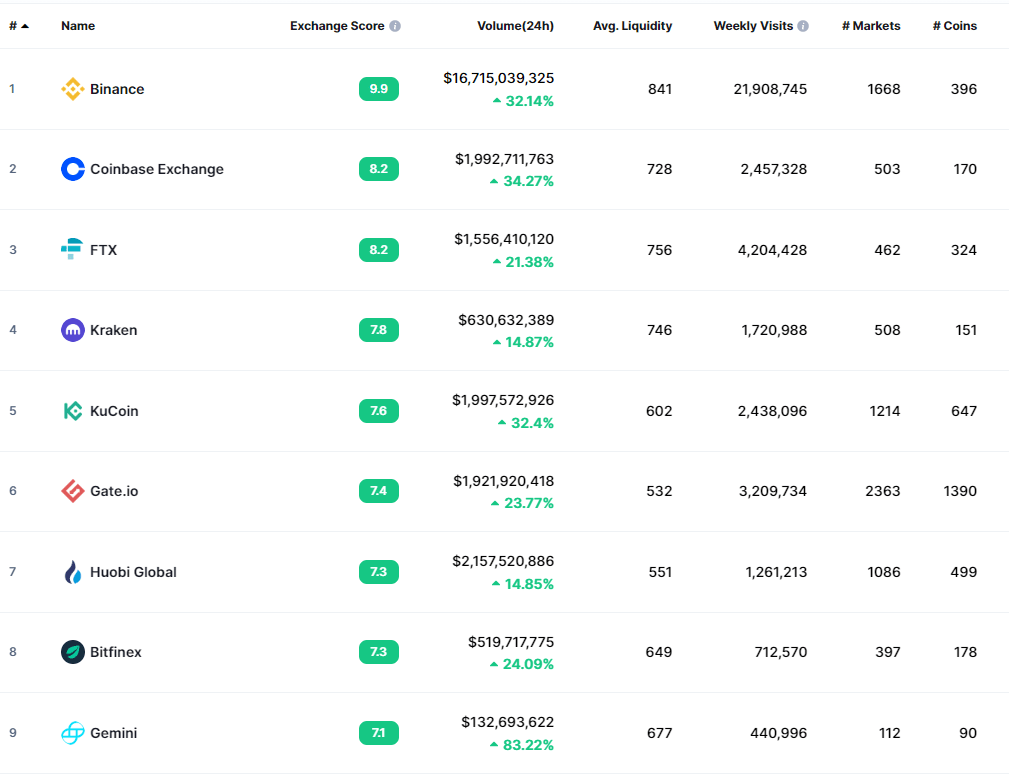

Market volatility is often linked to the huge losses (or gains) that are made by leveraged traders. Some consider Cryptocurrency Exchanges as betting halls and it should be noted that some Central Exchange owners are now amongst the richest people in the world! It seems the ‘house’ usually wins! Some of the most well-known cryptocurrency exchanges are:

-

-

- Coinbase (CEO Brian Armstrong worth $13 Billion)

- Gemini (CEO Winklevosss twins worth $4.1Billion)

- Binance (CEO Changpeng Zhao worth $77 Billion…. erm ….. that means that he is worth more than 82 of the worlds countries!!)

- Crypto.com (is very new but the CEO (Kris Marszalek) is already worth $150Million).

-

While a CEX may seem complicated for the beginner (sorry for the pun) there are some really fun and interesting options to explore (sorry for the pun). Crypto.com for instance offers a really nifty set of credit/debit cards for you to spend your crypto or fiat! The main features of four of the most popular Central Cryptocurrency Exchanges are:

Coinbase |

Gemini |

Crypto.com |

Binance |

|

| Buy/Sell Fees (Maker/Taker fees) |

1.99%/1.99% | 0.4%/0.4% | 0.4%/0.2% | 0.4%/0.2% |

| # Cryptocurrencies | 100+ | 50+ | 170+ | 600+ |

| Ease of Use | Easy | Easy/Medium | Medium | Medium/Complex |

Figure: Comparison of the more popular Cryptocurrency Centralised Exchanges

The largest Cryptocurrency Exchange is Binance and it is continuously under fire and scrutiny from government institutions and banks. I think that they feel threatened by it’s success. Banks for instance, have restrictions on depositing money to Binance – for our own protection no less! I wonder if the real reason is because they are seeing large amounts of money withdrawn to buy crypto. A Central Exchange is in direct competition with banks. Lately, Exchanges have also been providing staking services that give annual percentage rates (APR) of interest that are ten to twenty times higher than high street banks!

Figure: Not all exchanges are reputable, the green indicator above is provided by CoinMarketCap website and is a reputation indicator. There are some in the list which have a very high volume reported daily, but their figures simply aren’t believable!

Figure: Although the Hoo exchange is reporting very high daily turnover, their reputation brings such claims into question. Cryptocurrency Exchanges deal in very large sums of money and that doesn’t make them trustworthy. When trading, remember that it’s the exchange that usually benefits the most! I personally don’t trust exchanges and make it a point to transfer my money off their systems and into my own hardware wallet as soon as I’m able.

There are many Central Exchanges to choose from and as long as you use one that is established (and know how to get around restrictions your bank may place for transferring money) you should be ok. I would strongly recommend that you do not keep your crypto on an exchange unless you intend to trade it. For security reasons, it is always best to use your own wallets to store crypto.

Decentralised Cryptocurrency Exchanges

One of the biggest issues with buying and using cryptocurrency financial services is that they are managed and controlled by central entities or organisations and regulated by central authorities or governments. These institutions have very poor reputations, especially after causing the recession in 2008 and after all the problems caused by money printing in the last two years. Many are even seen as corrupt or at the very least extortionately inefficient and not cost effective. The simple task of transferring fiat money from an account in your country to an account in another country is time consuming and expensive. Buying cryptocurrency from your bank is a service that is currently not available in most countries.

The alternative is to use a Decentralised crypto EXchange (DEX). These exchanges allow for autonomous, cheap and very efficient forms of exchange. They allow hundreds or maybe thousands of different currencies to be traded. It is vital that they are outside the influence and control of individuals, institutions and governments and therefore seen to be incorruptible and free from bureaucracy. Some believe that buying cryptocurrency via a DEX is one of the most exciting innovations in finance since the checkbook!

When buying a cryptocurrency, a decentralised exchange (DEX) allows for very simple exchanges between cryptocurrencies using a basic interface. Importantly, a DEX is non custodial so it doesn’t actually take your money/currency and store it on the exchange for trades. It makes exchanges directly to and from your wallet.

Figure: Exchanging BNB Tokens for Cake Tokens using the Pancakeswap Decentralised EXchange

Figure: Exchanging BNB Tokens for Cake Tokens using the Pancakeswap Decentralised EXchange

Because it’s decentralised, the DEX uses smart contracts to perform the exchanges. Party A has a specific amount of currency X and gives it to Party B provided Party B gives a specific amount of currency Y in exchange. Simple! There are no third parties taking fees off-the-top, no opportunities of bureaucracy or fraud and because the application is not centralised, it is free from interference.

DEX’s are used by up-and-coming crypto projects that can’t easily get their coins traded on Central Exchanges. In my experience a DEX is very easy to use and absolutely trustworthy. There is at least one Decentralised Exchange for each of the major Layer 1 Blockchain Networks that can utilise smart contracts.

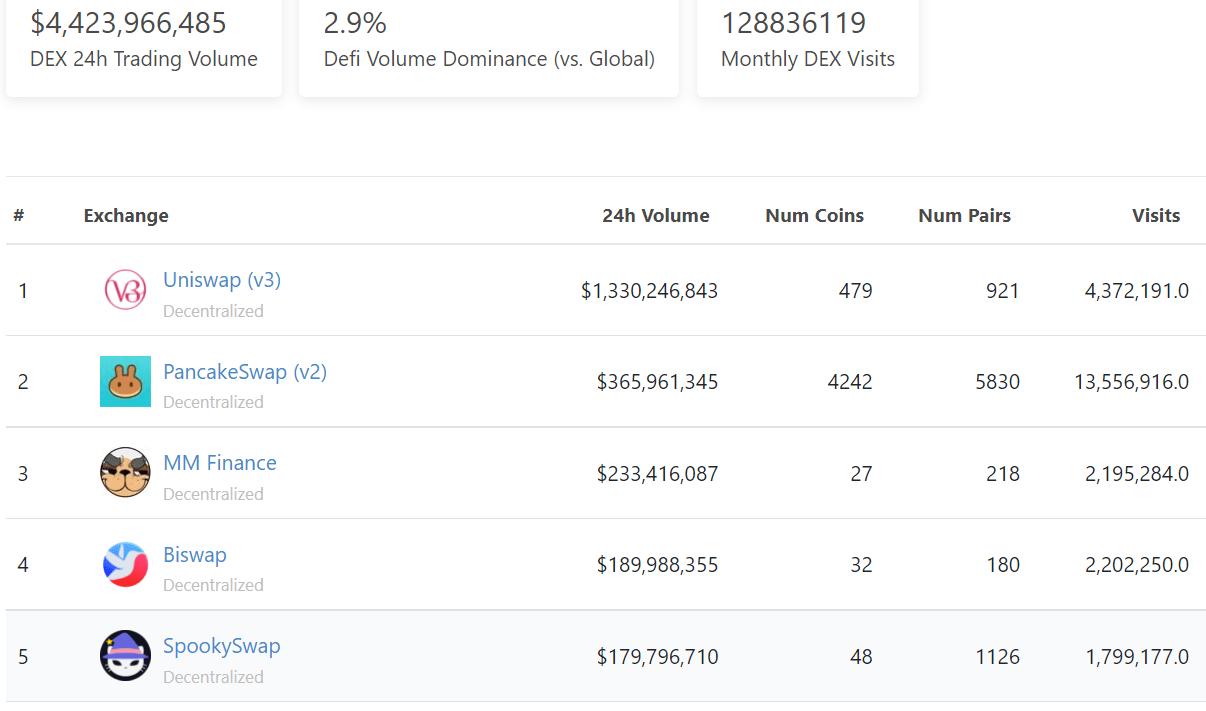

Figure: Comparison of the top 5 Decentralised Exchanges. Note that they (at the time of writing) have around $4 Billion trading volume per day which is still less than 3% of all the crypto traded. It is definitely becoming more popular, last year it was less than 1%.

When buying cryptocurrency, Decentralised Exchanges are somewhat anonymous and there is nothing institutions or governments seem to be able to do about it. Users can trade immediately without logging in and retain their private keys at all times. It’s easy and fast and more and more people prefer doing spot trading this way. Centralised Exchanges are certainly the most used but they are keen to take on some of the efficiencies and trust-less services that the DEXes offer.

The whole decentralised thing is very exciting for crypto enthusiasts because of its trustless. Binance for instance, is a central exchange that turns over billions of dollars each day. However, I challenge anyone to find out where the head office is located? Sure, there are offices in all major countries but not an obvious head office? Although Binance has a registered HQ in the Cayman Islands, in 2020, Changpeng “CZ” Zhao famously said, “Binance doesn’t have a headquarters because Bitcoin doesn’t. Wherever I sit, is going to be the Binance office.” This is not seen as a trustworthy trait for a global company – especially by governments that want them to be regulated.

When buying cryptocurrency, both DEX’s and CEX’s have their advantages and disadvantages. The decentralisation of an exchange is in line with what many believe Satoshi Nakamoto hoped for Bitcoin. For many traders however, the performance, flexibility and huge number of financial services and tokens available is a compelling factor in the continued use of central exchanges like Binance. Centralised Exchanges however, have recognized the advantages of DEX’s and are working on their own variants and other trust-less decentralised innovations.

This may be a little too intensive for people new to crypto so in section fourteen we will show you some alternative ways you can still be part of the crypto revolution without actually using crypto exchanges. Section Fourteen: Blockchain & Cryptocurrency Investment Alternatives.

This article is copyright 2022 by Tony Fawl, CryptoNET.

This page is part of the How to Crypto Web Series, an awareness course for beginners interested in blockchain projects and cryptocurrency investment. Please checkout the Bibliography and Glossary of Terms pages for other useful resources and links. To find out what we do, take a look at the About Us page.

Disclaimer: CryptoNET.org.uk is not a registered investment, legal or tax advisor or a broker or dealer. All investment/financial opinions expressed by CryptoNET.org.uk are from the personal experiences of the owner of the website and are intended as educational and entertainment material. Best efforts are made to ensure that all information is accurate and up to date but we would still recommend that you do your own research before buying cryptocurrency.

If you have found this page useful, please consider a small donation to help fund the site:

[crypto-donation-box]

Thank you.

Comments are closed.