ETH has declined by 19% over the past month.

Although Ethereum was experiencing strong downward pressure, an analyst eyes a historic rally.

Since hitting a local high of $3.4k a week ago, Ethereum [ETH] has experienced strong downward pressure. After the market crash that saw the altcoin dip to $2.1k, it has failed to reclaim a higher resistance level.

At the time of writing, Ethereum was trading at $2,695, marking a 5.05% drop in daily charts. The altcoin has also dropped on weekly and monthly charts by 16.51% and 19.11% respectively.

With the recent price drop, key stakeholders have shared both optimistic and pessimistic views of ETH in equal measures.

One of the most optimistic individuals is popular crypto analyst Ali Martinez, who has suggested a major move for ETH.

Market sentiment analysis

In his analysis, Martinez posited that Ethereum is currently gearing up for a major move to the upside. According to him, the prevailing conditions positions ETH for a potential breakout above $4,000.

Source: X

This analysis observes that if the altcoin manages to breach this resistance, it will pave the way for a parabolic rally.

Therefore, ETH would rally toward $7.4k, $10k, and hit a historical $14k. However, it’s vital to note that, these levels are long-term and highly unlikely to occur in the short term.

Could Ethereum see a strong rally?

While the analysis provided above by Martinez offers a promising outlook, AMBCrypto’s analysis tells a different story.

According to AMBCrypto’s analysis, Ethereum was experiencing strong downward pressure, especially in the short term.

Source: Messari

For example, Ethereum’s Sharpe Ratio (90 days) has been declining hitting negative territory.

At press time, this metric stood at -0.266. Such a sustained decline implies that a risk-adjusted return over the past 90 days is worse than a risk-free asset.

Therefore, ETH is failing to compensate traders for the risks they take thus making the crypto less attractive to investors.

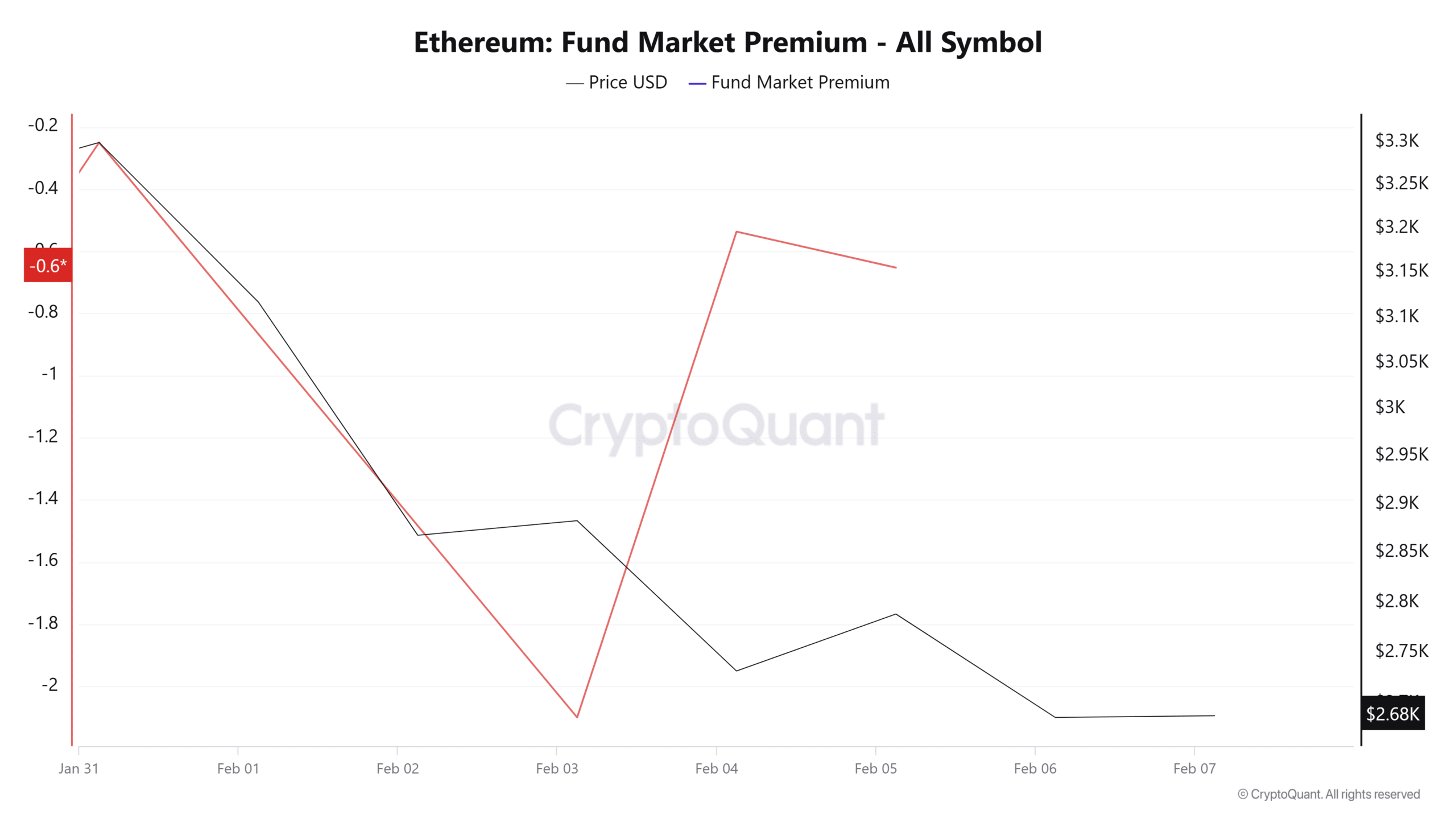

Source: CryptoQuant

Additionally, Ethereum is experiencing strong bearish sentiment as evidenced by a negative Fund market premium.

This has remained negative throughout the week implying that most investors are taking short positions and anticipate prices to drop.

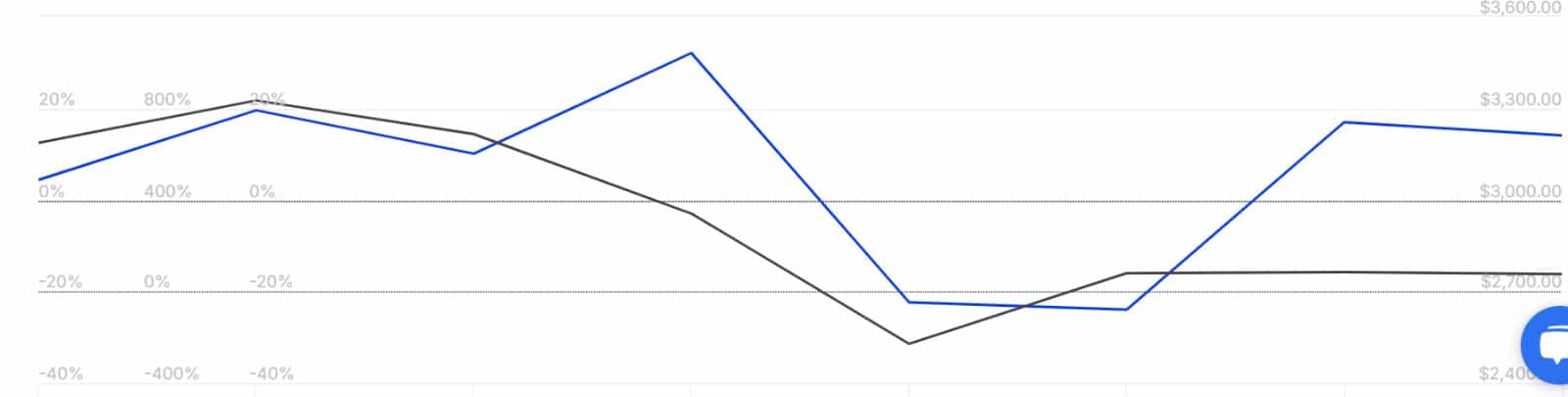

Source: IntoTheBlock

Finally, whales have turned bearish as they increase their deposits into exchanges. The Large Holders Netflow to Exchange Netflow Ratio has risen to 14.09% from -23.91.

With more large holders transferring their assets to exchanges, it causes selling pressure, further pushing prices down.

What’s ahead for ETH?

Simply put, Ethereum is experiencing short-term downward pressure and could see more losses before a rebound.

Is your portfolio green? Check the Ethereum Profit Calculator

If the current conditions continue, and ETH breaches its critical support of $2.7k, it could further drop to $2500.

However, a trend reversal will see the altcoin reclaim $2710 and attempt a run to $3000. The rally predicted by Martinez is unlikely in the short term, but in the long run, ETH will hit these levels.

Comments are closed.