Bitcoin dominance remains high but faces resistance, and its near-term breakout above $90k appears unlikely.

Is liquidity poised to rotate from Bitcoin into altcoins?

The cryptocurrency market is flashing strong altseason signals, with historical cycles and technicals aligning.

In both 2017 and 2021, altcoins surged after Bitcoin [BTC] topped and entered consolidation.

Currently, alts are reclaiming key resistance zones, while Bitcoin dominance faces structural resistance, increasing the likelihood of capital rotation.

Could Q2 deliver the most explosive altseason yet? The probabilities are stacking up.

The case for the biggest altcoin season yet

Bitcoin dominance (BTC.D) has climbed to 62.40%, levels not seen in four years.

However, with the RSI nearing overbought territory, history suggests a pullback could be on the horizon. If Bitcoin dominance peaks, it could signal a shift, giving altcoins room to shine – just like in 2021.

Back then, BTC.D dropped to 40% by mid-Q2, while the altcoin market surged to a record $1.50 trillion. But it wasn’t just luck.

Source: TradingView (BTC.D)

The rally occurred during a post-election economic shift, rising inflation, and pandemic-driven policies. Similar forces are at play today.

Currently, the altcoin market cap remains under $1 trillion, with the RSI showing signs of bottoming out. This suggests a potential breakout may be on the horizon. Altcoins are hovering around a critical $900 billion support level.

However, for a true altseason to emerge, Bitcoin dominance must decline. At present, BTC.D is at a three-year high, while altcoins face double-digit losses.

With macroeconomic volatility on the rise, could this present an ideal opportunity for strategic risk management into low-cost alternatives?

True diversification if Bitcoin dominance retreats

Bitcoin dominance is a key signal of whether investors are moving into altcoins. But in this cycle, two major players – Ethereum[ETH] and Solana[SOL] – have already lost strength against BTC, breaking multi-year support.

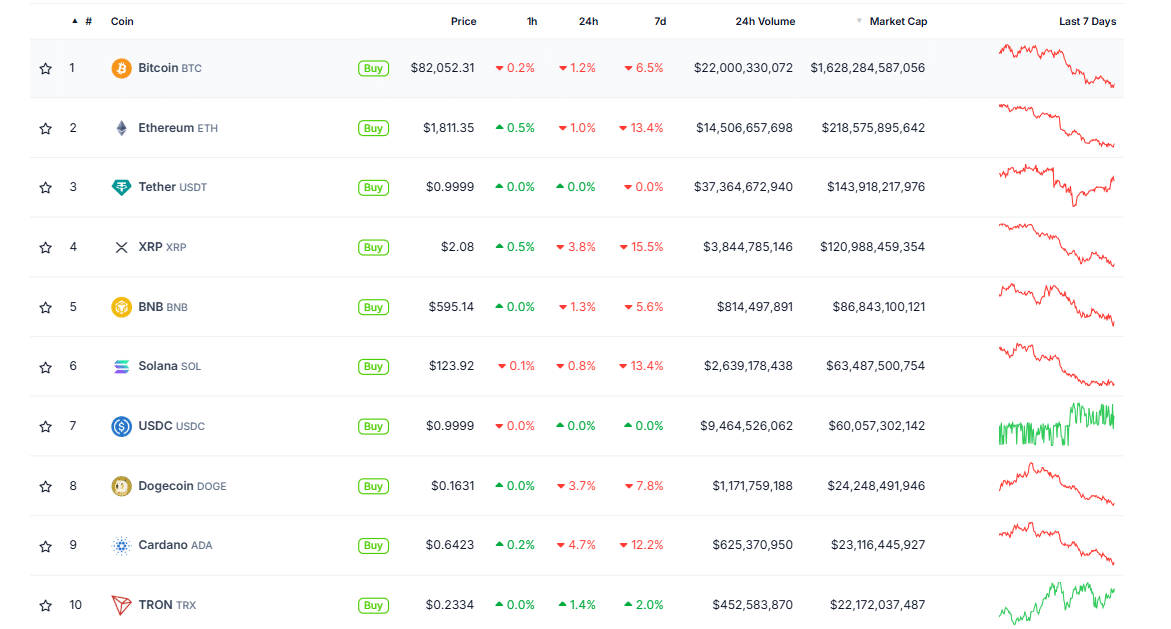

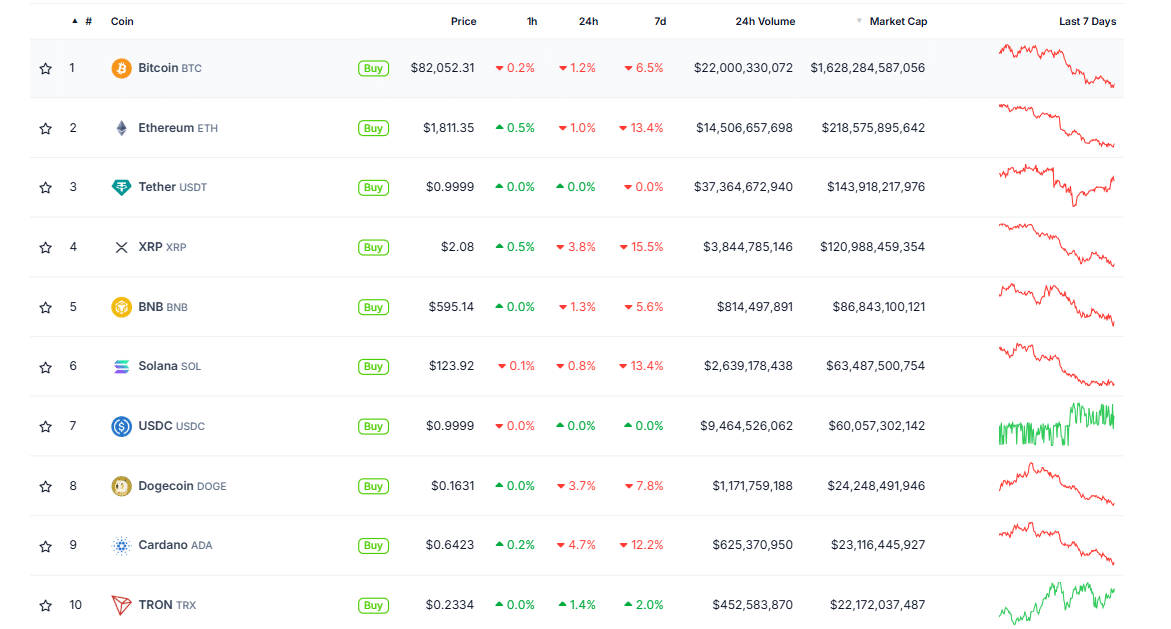

The impact is clear. ETH and SOL are down over 13% this week, while Bitcoin has only dropped 6%. Mid-cap alts? They’ve been hit even harder.

Source: CoinGecko

Still, some analysts remain bullish, predicting the biggest altseason yet. They point to macro factors and Bitcoin’s consolidation as the perfect setup.

The market is currently split between three BTC scenarios: A slow bleed to $50k–$60k, a multi-month range between $70k–$90k with choppy alt moves, or a breakout above $90k, which seems less likely without a macro shift.

The most likely outcome? Bitcoin ranges, giving altcoins time to consolidate and set up for a strong move. With many already down 80–90% from their highs, a full recovery might not take years – Just the right conditions for a rotation.

If this plays out in the coming months, Bitcoin dominance could see a 2021-style breakdown, with both technicals and macro trends aligning.

And if that happens, altcoins might finally get the explosive season they’ve been waiting for.

Comments are closed.