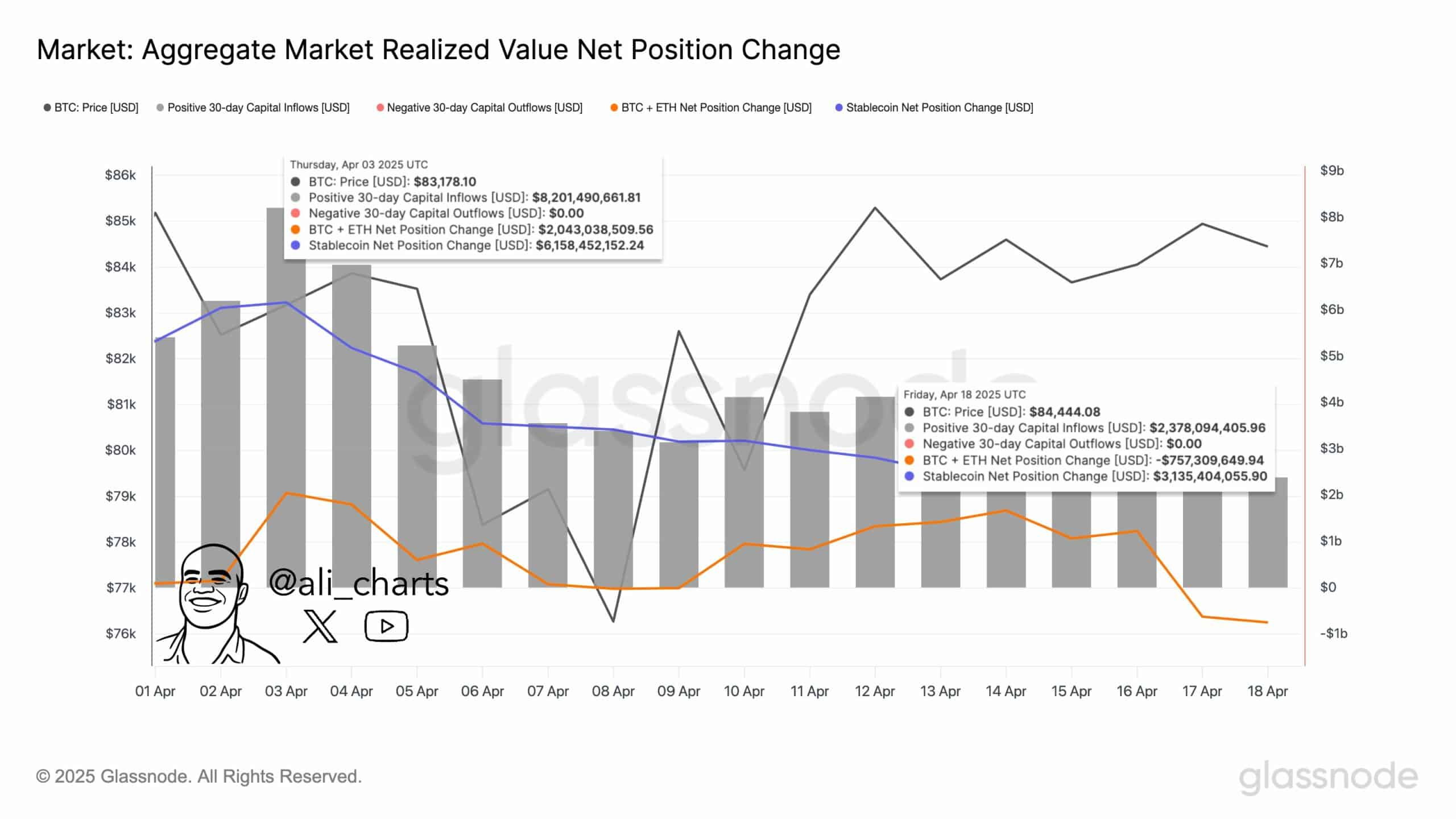

Crypto capital inflows have plunged 70% in two weeks, while fear levels have remained unchanged.

Bitcoin ETF inflows remained strong, signaling institutional conviction amid retail pullback.

Capital inflows into the crypto market have plunged sharply by over 70% in just two weeks, collapsing from $8.2 billion on the 4th of April to just $2.38 billion by the 18th of April.

This dramatic contraction reflects a wave of investor caution amid rising market volatility and intensifying macroeconomic pressure.

The sudden slowdown signals a shift in risk appetite, as both retail and institutional participants trim exposure to volatile assets.

Although the market had sustained bullish momentum earlier in the year, current conditions suggest that participants are reevaluating their positions in response to the broader economic environment.

Source: X/ Ali_Charts

Why fear is gripping the crypto market again

Of course, sentiment data backed this behavioral shift. The Fear and Greed Index held steady at 33—firmly in “Fear” territory.

This level has remained unchanged for weeks, hovering at 32 last week and 31 the previous month. Therefore, the market is trapped in a psychological standoff, with buyers reluctant to step in aggressively.

Historically, prolonged fear phases have preceded both sharp rebounds and deeper corrections.

However, the lack of volatility in sentiment implies hesitation rather than panic, hinting that participants are waiting for stronger macro or price cues before making decisive moves.

Source: CoinMarketCap

How inflation fears are weighing on crypto confidence

On top of that, macro pressure only intensified. According to the recent data, 1-year inflation expectations surged 1.7 percentage points in April, hitting 6.7%—the highest level since 1981.

This marks the fourth straight monthly increase, with inflation expectations rising a total of 4.1 percentage points since November 2024.

Moreover, 5-year inflation expectations now sit at 4.4%, the highest since June 1991. At the same time, consumer sentiment has dropped to its second-lowest level on record.

Together, these figures screamed stagflation. And of course, crypto—still viewed as a high-risk asset class—suffered from this growing fear.

Can ETF inflows prevent a full-blown retreat?

However, there is a bright spot amid the gloom. Bitcoin [BTC] ETFs recorded a $107 million net inflow on the 17th of April alone, lifting the monthly total to $156 million.

In fact, over the past three months, net ETF inflows crossed $1 billion—showing that institutions didn’t completely back away from crypto.

While Ethereum ETFs remained flat, this divergence highlights Bitcoin’s perceived strength as a safer bet.

Additionally, sustained ETF inflows may offer the market a degree of stability and prevent panic-driven capitulation in the short term.

Source: CoinMarketCap

Where does the crypto market go next?

The sharp drop in capital inflows and persistent fear signals growing caution. However, steady institutional inflows through ETFs suggest investors are not abandoning the crypto market.

Instead, this appears to be a short-term reset driven by macro fears rather than a structural breakdown. If inflation expectations stabilize and sentiment improves, crypto markets could find footing for a renewed rally.

Comments are closed.